FTX or Church and State discord

Last week has been one of the worst period in the crypto-ecosystem due to Alameda & FTX turmoil and bankruptcy.

I think details about the case have largely been covered but here is a twitter 99 seconds video that sums up the cascade of events for those willing to refresh the memory:

The principal cause of this turmoil relies on the blurry frontier between Alameda Research (investment arm) and FTX (custody and exchange platform). In short, Alameda secretly (i.e. illegally) borrowed FTX users deposits’ without their consent and Alameda lost it all.

It is not the first time church (retail banking) and state (investment banking) are not separated and not the first time it fails (remember 1933 & 2008?).

C.f. a thread I wrote 10 days ago about the link between financial instability and retail/investment bank collusion.

The unprecedented bankruptcy also has to do with factors that go beyond the porous boundaries between FTX and its investment arm Alameda. A total lack of accounting, tax and operational control of operations (SBF is said to have personally taken out a $1 bn loan to Alameda) proves a huge spectrum of failure reasons.

To sum up and after reading confusing and false elements in many articles, here are some basic points to remember from these events:

FTX is a centralized custodian platform, just like your average retail bank. The main difference is that it was operated with no risk management, accounting and was under loose compliance and regulation supervision.

FTX is not MEGA or Pirate Bay with a bunch of persons operating 100% illegally. The FTX US branch was supervised by the SEC and SBF (FTX leader) worked hand to hand with US regulators.

FTX proves that badly regulated centralised finance can fail fastly and tremendously and don’t deserve to be trusted at first sight.

As Walmart is selling chocolate but is not a chocolatier, FTX dealing on top of crypto does not make it a blockchain product.

FTX failure has almost nothing to do with decentralised finance.

The contagion of bankruptcy to other centralized platforms and institutions is yet to be discovered.

Now that we're good, we can switch to more thrilling topics.

Three questions to Centrifuge Protocol

Please introduce this new section where I leave the mic to real world DeFi protagonists. The goal? Introducing what their company is working on and the problem they are trying to solve. Also, in a broader picture, talking about the main challenges faced by the nascent real world DeFi ecosystem.

For the first interview, I asked Asad Khan, DeFi politician and responsible for Protocol Partnerships to introduce Centrifuge and answer three questions about the Centrifuge team’s vision of real world DeFi ecosystem and its main challenges.

Centrifuge Introduction

Centrifuge is a decentralized finance protocol that facilitates real world asset financing. Since 2018, our goal has been to allow borrowers and lenders to transact without unnecessary intermediaries, ultimately lowering the overall cost of financing and offering better liquidity. We aim to fundamentally improve traditional credit markets and provide a foundational offering for the DeFi ecosystem. Our vision is to fix the persistent gap in global SME financing, directly related to the intermediate costs and frictions that plague the traditional finance.

Why Centrifuge is THE protocol for real-world DeFi applications?

The Centrifuge protocol is designed to support the entire world of credit coming on-chain. This means being able to facilitate: asset tokenization with sufficient privacy, a transparent and automated securitization engine, deep integrations with DeFi capital markets, and on-chain structures backed by a strong legal framework. With this foundation in place, we are building features to enable institutional-quality collateral, improved lending processes, and community-driven decentralized governance.

Ultimately, to truly disrupt credit markets will require a principled approach and a deep commitment to a long-term perspective. We believe we can do this by blending the best practices of TradFi (i.e. secured and collateralized lending) with the best practices of DeFi (i.e. composable, decentralized, transparent).

What is the next big thing for Real World DeFi and the narrative for its mass adoption?

Maturity and institutional participation.

For DeFi markets, traditional credit products are complex and difficult to understand. As crypto-native yields suffer in the bear market, DeFi participants will begin to better understand how certain real world asset opportunities can provide critical advantages. This will take education and learning, community collaboration, and a deep desire to build long-term sustainable structures in DeFi.

For RWA protocols, institutional participants provide the greatest opportunity to build stability and reliability into their offerings. Getting these participants to come to the table, as builders and long-term DeFi participants, is the biggest key, and the biggest challenge.

Permissionless vs. permissionned DeFi. How do you think the industry will evolve around this schism?

Compliance and regulation will always be a critical part of any “real world” asset offering. This can introduce incredible inefficiencies, especially when compared to the available transparency and digital capabilities of blockchain. Until laws and regulations adapt to take advantage of this and be more “technology-active”, rather than the traditional “technology-neutral” approach, we will see challenges in enabling permissionless and compliant lending at scale. At a time when regulatory scrutiny has never been higher, DeFi must continue to build towards the vision of more efficient, more transparent, and more equitable systems.

A few important things to remember about Centrifuge is that the protocol focuses on giving access to high quality credit (comprehensive due diligence done on borrowing companies, borrowing with collateral) to KYC-enabled participants.

Furthermore, in the course of our exchanges, Asad mentioned to me the growing desire to deal with institutional partners (illustrated by their partnership with Blocktower)

Finally, one of the main challenges is also to reconcile the permisionned aspect of their protocol (mandatory from a compliance standpoint) with the ease of onboarding users both from a privacy (with ZK-enabled id) and convenience (Universal ID on-chain) point of view.

Risk free rate convergence between tradFi and DeFi

“Only a person who risks is free.” William Arthur Ward

The risk-free rate is a fundamental concept in today's financial world, dictating both theoretical models and technical implementations. I wanted to show how it applied to decentralised finance, the distinction with its form in traditional finance, and a possible convergence in the future.

Risk free rate should be approached by its formal definition first, then by real world approximation and illustration.

From a theory perspective

The risk-free rate of return is the theoretical rate of return of an investment with zero risk. It represents the interest an investor would expect from an absolutely risk-free investment over a specified period of time.

First, risk-free rate is THEORETHICAL. A truly risk-free rate does not exist because even the safest investments carry a very small amount of risk.

Furthermore, there is no absolute risk free rate, it always depend on an investor and investment perspective.

In practice - Traditional Finance

For instance, the interest rate on a three-month U.S. Treasury bill (T-bill) is often used as the risk-free rate for US-based investors. An investor in Japan would consider the risk-free rate as Japan 10-Year Government Bond Interest Rate (0.25% at today’s mark)

Besides, a foreign investor whose assets are not denominated in dollars incurs currency risk when investing in U.S. Treasury bills. It could partially eliminate it by buying options, hedges etc. but interest rate would be different.

Furthermore, as soon as counterparties are involved, risk is inflated from an operational and financial perspective. For instance, even if you buy US Treasury bonds, they are not bought directly from the US government, but from brokers who may be defective.

To summarise, it is good to take into account the duration of the investment, where the investment is made, the currency, and all the counterparties to which one is exposed in a transaction to give context to the risk-free rate.

A few examples of risk free rates

Here are some examples of rates that are considered empirical approximations of the theoretical risk-free rate.

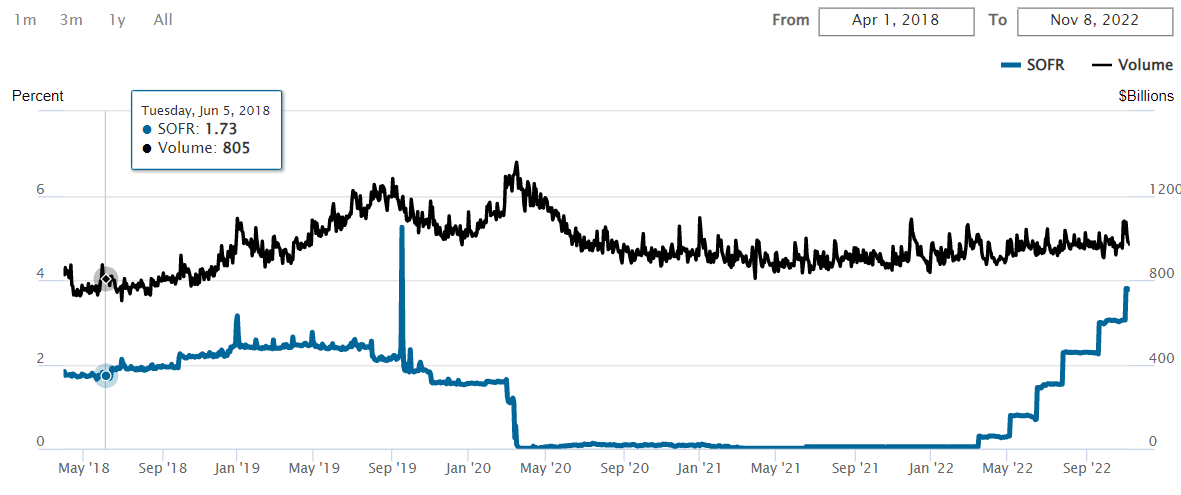

SOFR

The daily Secured Overnight Financing Rate (SOFR) is based on transactions in the Treasury repurchase market, where investors offer banks overnight loans backed by their bond assets.

SOFR is essential in the trading of derivatives—particularly interest-rate swaps

and is a robust representation of the near risk-free rate (RFR).SOFR rate yield is denominated in USD and there is no secondary liquidity to exit the position before the term.

Treasury bills

T-bills are issued by the US government to fund public projects, such as the construction of schools and highways. T-bills are considered a safe and conservative investment since the U.S. government backs them.

T-bills have maturity up to 1 year (52 weeks), common maturities are four, eight, 13, 26, and 52 weeks.

Secondary markets exist but there is no primary liquidity to T-Bills. Furthermore, they are also denominated in USD.

In practice - Decentralised finance

The risk-free rate in decentralised finance could be defined as the capital return earned in an activity if it performs according to expectations at the code level. That is, there is systemic risk due to the programming, but external risks such as investment behaviour, economic activity are negated and does not jeopardize a capital loss.

To my mind, it can take three forms.

Staking yield - Lido

The purest form is native token staking yield to secure the blockchain. From an on-chain perspective, the most basic risk is that of having the blockchain infrastructure fall down. The rate earned to secure it therefore reflects the risk-free rate in that perspective.

The rate is volatile and depends on multiple factors: number of nodes securing the blockchain, blockchain activity, potential penalties due to bad behaviour.

Thus there is no single rate, but a theoretical rate that can be approximated by averaging the performance of each node.

Thus, it must be taken into account that a validator/staker A can have a yield of 4% and a staker B of 6% thanks to a differential in performance (number of failed validations) and also in luck (number of blocks allocated for a proposal).

This investment is denominated in blockchain native token. (ETH for instance).

Unlike treasury bonds, staking is an indefinite investment in time (no 3-6 month staking on ethereum), with potentially infinite liquidity (as soon as it will be possible to withdraw ETH from staking nodes).

Staking investment is available directly by setting up your own ETH nodes, but also through counterparties such as Rocketpool or Lido, that creates an additional risk layer (protocol design, smart contract risk).

A less purest form is yield for providing liquidity to overcollateralized loans.

The yield is even more volatile than staking because it depends on underlying pool utilisation rate (borrow/supply). It also faces smart contract (hacks) and protocol design (liquidation) risks.

The yield is denominated in any currency (e.g. USDC), with no time horizon and a theoretical instant liquidity depending on the utilisation rate.

Overcollateralized loans could be accessible through many protocols (Aave, Compound, Euler etc.) on many different pools (stablecoins) meaning that there is no main benchmark.

Stable LP

Another, almost pure form of risk free rate is providing liquidity to stableswap pools.

The yield is volatile because it depends on underlying pool activity (number of trades). It faces smart contract and stablecoin de-peg risks.

The yield could be denominated in any currency (e.g USDC), with no time horizon and a theoretical instant liquidity depending on the utilisation rate.

As for overcollateralized loans, a bunch of pools (depending on stablecoins) on many protocols (Curve, Uniswap, Sushiswap etc.) offer similar liquidity providement activity: no benchmark rate.

RWA DeFi - On chain treasury bills.

Several decentralised finance protocols now provide access to investments in real assets, including Cytus Finance with US treasury bills.

These on-chain financial products are linked 1:1 with real treasury bills and share several characteristics: the level of interest rates, the denomination in dollars.

However, there are some notable differences:

Bonds are available in pools, so there is no set investment time. Pool yield is a bit lower than tBills rate because of pool cash drag.

These investments also involve several economic intermediaries (market makers) or technological intermediaries (blockchain, protocol) that are not present on an off-chain t-Bills.

Risk free rate convergences ?

The concrete examples of empirical approximation of the risk-free rate in traditional and decentralised finance are quite different on several points.

The investment horizon: Overnight or a few months (T-Bills) in TradFi - Unlimited in DeFi.

Rates: stable in TradFi - variable in DeFi.

Liquidity: secondary market in TradFi - primary liquidity in DeFi depending on the capital utilisation of the pool

The uniqueness of the SOFR/T-Bills rate versus the plurality of staking rates (depending on each validator) or lending and stablewap pools in DeFi

Risks nature is also different: liquidation for collateralization, de-peg for stableswap LPs etc.

However, the arrival of real financial assets suggests that the DeFi and TradFi risk-free rates are converging.

For a hypothetically unlimited liquidity and an equivalent infra blockchain and smart contract risk, what would be the interest of an economic agent to stay in a Uniswap or Aave pool, if he could benefit from a government bond that pays better with a similar very low risk, denominated on the same currency?

A glance at on-chain credit protocol figures

The events of the last few days have seen major capital flight from the main on-chain credit protocols ($200M removed), but with fairly small defaults and localised in non-public pools.

Outstanding Loans:

Maple : $123M (-$154M)

Clearpool : $11M (-$84M)

Centrifuge : $78M (-$1M)

Ribbon : $10M (-$43M)

Goldfinch: $99M (+0)

Default:

Alameda exposure: $7M in TrueFi, $5.5M in Clearpool on permissioned pools. Exposure to DeFi of Alameda was minimal, given the overall market exposure to Alameda ($9Bn) and the amount of issued loans in the last 9 months(>1$bn)

A super clear thread about it: