All you need to know regarding standards and erc in DeFi

The quality of a leader is reflected in the standards they set for themselves - Ray Kroc

DeFi is not only about decentralisation.

Decentralisation is the core value of the underlying blockchain infrastructure and DeFi could not exist without it, but other characteristics show DeFi specific strenght compared to the traditional financial system.

Transparency is often depicted at the most important value at the core of trust. This characteristic of DeFi is articulated through smart contracts open-source access, real-time data availability. Platforms such as etherscan (for the first element) or Dune analytics for the second prove it is easy to explore the blockchain data and operations.

An often underestimated feature is composability. Decentralised finance by default and in particular thanks to its characteristics of decentralisation (no central authority) and transparency, allows developers to build products or tools that depend on other products or tools in the ecosystem.

This gives immense power to the ecosystem as knowledge is potentially acquired instantaneously (open source by default) and innovation is not restricted by any administrative, technical or political blockage

Crypto rails would not work without proper composability.

I will take rails and not crypto as an example to illustrate it.

Rails but not crypto rails

In Europe, trains can make cross-border journeys whether it be Lyria, Eurostar or Thalys.

In order not to recreate railway infrastructure, the new trains must respect the facilities of the passing high-speed or local trains in terms of size of platforms, rail gauge, materials used for the rails (electrical and rails themselves).

Thus we have an example of branching where international trains must be backward compatible with national or even regional facilities.

Railway network designers should maximising two variables: 1) respecting the specificities of international trains (they must run faster than regional trains) in terms of transport speed and passenger comfort, 2) while ensuring their modularity (i.e. the fact that they should ride anywhere if they have no choice).

It is a subject scrutinised by public services and good practice guidelines are even dictated by the European Union.

As infrastructure is expensive, slow and difficult to rebuild, the creation of new railway lines has to be considered with many parameters and interoperability (the ability of systems, units, materials to operate together) should prevail.

Decentralised finance resembles the railway network of the mid-19th century. The industrial revolution has been underway for many decades (years for DeFi), the creation of locomotives (kind of POC) was born and are used on a daily basis as a means of production (same for DeFi and AMM, staking, insurance). However, there is still a lot of work to be done to make the network dense and coherent on a national (global for crypto) scale.

In short, the POC has come into being and is working as intended, it now needs to be made consistent and stable at scale through interoperability (or composability).

Decentralised finance is railways in the 1850’s.

In DeFi - the importance of ERC

Ethereum at the infrastructure level is an immutable network and can only be altered by community consensus. However, Ethereum at the application level is not immobile and progresses according to the improvements one wishes to make while taking care to respect a certain cohesion with the past characteristics.

It is within this framework that the ERCs are studied, presented and implemented. Innovations on the borderline between infrastructure and application with global consequences on the network.

What are ERC and EIP

ERC stands for “Ethereum request for comment”.

“Request for comment” is a similar concept to that devised by the Internet Engineering Task Force as a means of conveying essential technical notes and requirements to a group of developers and users.

The Ethereum community uses a process called the ‘Ethereum Improvement Proposal’ (EIP) to review these documents.

Several aspects are presented in an EIP including its motivations, its technical specifications (i.e. the rules for following it) and also its interoperability with previous rules.

For instance various examples of EIP at the token level introduce “X standard Token Backward compatibility with Y”: meaning you can interact with X as if they were Y, using the standard functions.

This is a fundamental element of the strength of PIEs (no need to rebuild from scratch every time) and a keystone of composability.

Thousands of IEPs have been submitted over the past seven years. Here are some examples that deal with the standards adopted around tokens or the representation of value/decision power in the ecosystem.

ERC-20

Introduced in 2015, the EIP-20 proposed a standard interface that allows any tokens on Ethereum to be re-used by other applications: from wallets to decentralized exchanges.

Prior to this, it was not clear that a token used on one decentralised application would be recognised by another decentralised application, which severely limits the on-chain experience.

Almost all tokens issued on the ethereum network respect this standard today

In a way, the gauge of the rails of large locomotives require respecting certain standards.

ERC 4626

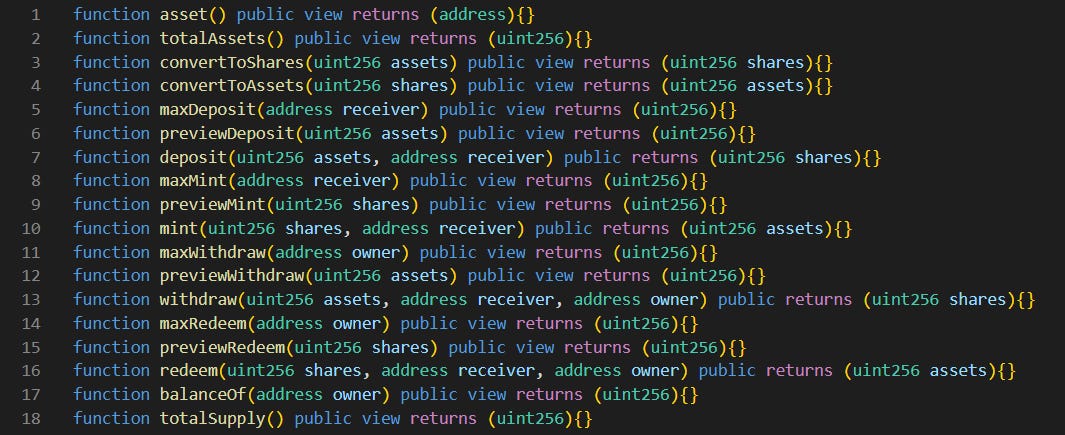

Created in December 2021 by Joey Santoro — founder of Fei Protocol, the ERC-4626 introduces an universal yield bearing vault in DeFi.

While an ERC-20 token is an excellent value exchange, voting or execution tool, it is not an appropriate financial investment vehicle. Even if an ERC-20 could have a primary and secondary value, it could not be pooled among many investors in a fund-like infrastructure.

Thus ERC-4626 are token representation of shares in a pool with an underlying asset (that could be represented itself as another ERC-4626, an ERC-20 or anything else.

The concepts of SPVs and securitisation are emerging on-chain.

Today, the ERC 4626 is still not a standard in decentralised finance, the token is nevertheless used by dozens of protocols (yearn, maple, morpho, balancer, alchemix).

The token is backward compatible with ERC-20.

ERC 1400

Created in 2018 by Polymath, the EIP 1400 has the same desire for securitisation and pooling of financial investment as the ERC 4626, except that it introduces an institution-grade token issuance with external actors integrated in the process.

The EIP highlights as main parameters of the token standard:

Core compliance components such as Operator, Controller. Predefined roles of authorities in the issuance or distribution process.

The inclusion of document handling and notification within the token standard

Security token control and permission including delegation and forced transfer/recovery

Partial fungibility with the personalisation and transparency of investors ownership rights

Also, this standard meets other ad-hoc standards created for the occasion:

ERC-1410: Partially Fungible Tokens

ERC-1643: Document Management Standard

ERC-1644: Controller Token Operation Standard

To date, this standard is only used by Polymath.

The token is backward compatible with ERC-20.

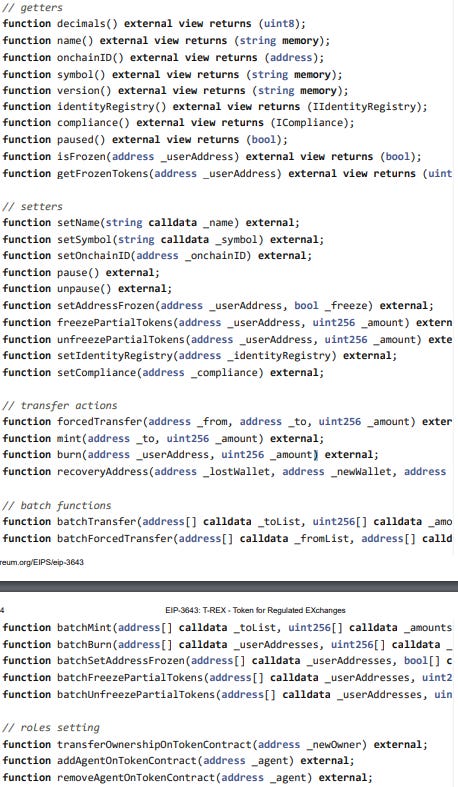

ERC 3643

In the same vein as the ERC 1400, the Tokeny team presented the EIP 3643 to propose another kind of security at an institutional level.

It introduces identity specificities directly into the standard as well as on-chain writing of access rights to the investment based on geographical, concentration, status etc.

The main characteristics are:

Identity registring (and associated whitelisting)

Compliance rules: max investor per countries, min amount etc.

Freeze/force transfer by a designated authority.

Compatible with 180 jurisdiction

To date, this standard is only used by Tokeny.

The token is backward compatible with ERC-20.

What is a good standard in DeFi?

As can be seen from the examples above, several types of standard have been introduced without necessarily being linked to each other (except with the canonical erc-20).

However, in order for trains to run everywhere, i.e. for a token representing a certain asset to be easily bought and exchanged by another counterparty, a minimum of coherence in the ecosystem is required.

Standards such as those of Polymath or Tokeny are a real feat in terms of technical specifications so that the issuance of on-chain financial securities is as close as possible to traditional finance. However, their technical complexity (ad-hoc fractionalization of shares, on-chain documentation) as well as the induced frictions (permissioned by default, difficulty to create a secondary market, creation of an administrative authority) make their adoption at scale impossible.

Fundamental issues at stake

Some concrete examples of problems caused by overly restrictive standards are the following:

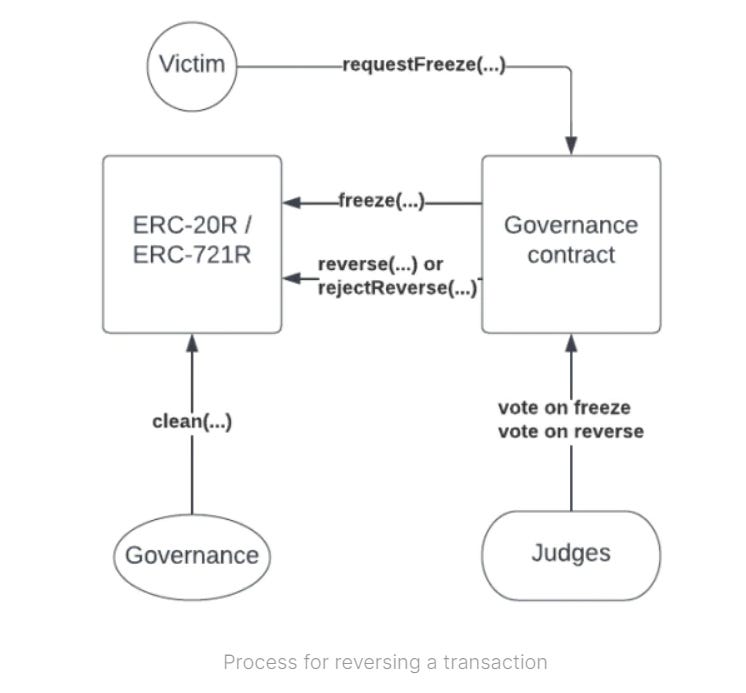

The act of freezing or flipping transactions can place severe constraints on composability. How can I be sure that I own an asset if a decision maker can take it away from me at any time?

The definition of supervisors over financial operations (operators, auditors) leads to multiple rules of practice and therefore sub-standards making the ecosystem complex and non-interoperable. In short, how can we be sure that an authority will not wish to create a new standard that is not backward compatible with the old one while respecting its issuing logic?

A big problem lies in the inclusiveness of a DeFi ecosystem that wants to be open. How can we promise the existence and then the liquidity of secondary markets if it is difficult to make tokens of the same nature programmatically compatible and to restrict access according to arbitrary and unique rules?

These issues are under scrutiny and will evolve as the ecosystem progresses.

My standard golden rules

In my opinion, a standard is more likely to be adopted on a massive scale if it meets these three criteria:

Simplicity: The standard is understandable by the majority of people according to global rules

Composability: the standard works with previous rules. It makes communication and construction easy between two projects, applications following the same requirements.

Completeness: Standard leaves little room to interpretation and is sufficient in itself. An application of the standard can perflectly work without other rules.

Standards composability

It is important to note that other standards can be used in addition to the token standards. This is the case of debates and standards around on-chain identity (for instance Solbound token or Verite).

Thus the identity can be verified elsewhere than directly on the security token, which simplifies it.

An interesting avenue of exploration is the creation of an ERC-20R standard making it possible, under certain conditions, to reverse token transactions.

Five questions to TrueFi

For the second interview on the Elephant in the Room I had an insightful discussion with Tyler, Head of Product at TrueFi:

Hey Tyler! What is TrueFi?

Tyler: TrueFi is one of the first and largest credit-based lending protocols. Since its launch in 2020 TrueFi has originated over $1.7 billion in loans, returned over $40mm in interest to lenders, and maintained <0.3% default rate to date.

Why is TrueFi THE protocol for real-world DeFi applications?

Tyler: TrueFi removes barriers for managers and lenders who want to bring sophisticated deals to market, using DeFi rails to cut out middlemen, reduce friction, and improve transparency.

TrueFi has helped bring capital to emerging fintech companies and has an ecosystem of participants ready to help lenders, borrowers, and managers organize deals that meet their needs.

What is the next big thing for Real World DeFi and the narrative for its mass adoption?

Tyler: Broadly speaking, I think the “next big thing” is when DeFi launches financing deals that show clear economic advantages over the traditional financing rails. This can be achieved via several means. For example, programmatic payment waterfalls improve security and reduce cost, as mentioned in this notboring piece from Kevin at BlockTower.

It might take a while to notice these deals as they’ll start quietly with some niche and upstart early adopters, but it turns into something big once it’s proven out. DeFi represents ~$50bn TVL in total today, while big banks are regularly doing trillions of dollars of loans and bond deals per quarter (see FT league tables for example).

Permissionless vs. permissionned DeFi. How do you think the industry will evolve around this schism?

Tyler: It’s clear that many “real world” use cases will require permissioning. I believe that the most successful protocols will give users the tools to configure what they need.

Good infrastructure is open and credibly neutral. Where permissions are needed by users, access must be governed by clear, transparent processes.

What would you change if TrueFi had $50bn TVL tomorrow in terms of risk/compliance process? or infrastructure? (i.e. would you keep building on ethereum)? or regulation?

Tyler: At $50bn TVL, we’re talking about powering highly sophisticated markets at scale. I expect such a market offers a wide array of opportunities with diverse risk/return and liquidity profiles. We’ve created building blocks towards this with our new Structured Credit Vaults™ that enable TrueFi to accommodate deals of many shapes and sizes through support for multiple tranches, a streamlined capital formation process, and more.

In terms of infrastructure, I expect we’ll see more pieces that help lenders and borrowers move seamlessly between on/off chain. RWA borrowers want to receive funds directly into their bank account or venue where they will use the proceeds. Similarly, many credit lenders want to wire funds straight to a smart contract. Some great teams are working on these challenges today, and I expect we’ll see products land that unlock more of this type of activity over the next 12 months. (contact me if you’re building something here!)

Can i have your thought on composability (in terms of kyc, secondary markets, token standards) between protocols in case of very fragmented and gated DeFi ecosystem?

Tyler: Composability is one DeFi’s superpowers. It’s one of the key things that reduces friction vs. the status quo. The TrueFi ecosystem is already working with teams like Circle to create building blocks for decentralized IDs (see more about Verite here). TrueFi also recently adopted ERC-4626 standards across its contracts so that lenders can easily integrate with TrueFi – lenders use the same standard interactions when interacting with Yearn, TrueFi, and other yield generating protocols.

Up until a few months ago, TrueFi pools used Curve for a “cash sweep". That’s ended for various reasons but going forward we should see more composability like this. I envision future portfolios on TrueFi that hold assets across multiple protocols, multiple asset classes, and perhaps can even buy/sell assets on secondaries.

My takeaway from my exchange with Tyler is that the ecosystem is really in its infancy. Lending and borrowing volumes are low compared to the real industry (less than 0.01%) and there are still a lot of frictions for businesses to move off and on-chain.

Nevertheless, TrueFi (like others) is looking to leverage the advances in ecosystem standardization (ERC-4626, decentralized ID) and communication (with other protocols) to offer a financial infrastructure that can on-board a lot more use cases.

A glance at on-chain credit protocol figures

After a massive repayment of capital due to the more than uncertain situation of the DeFi ecosystem after FTX ($200M out of the pools), there is a stabilisation of on-chain loan amounts. The $15m drop is again due to amounts that were not repaid.

The contagion of the FTX bankruptcy keep going on with new trading and market making companies at risk: Auros and Orthogonal.

Outstanding Loans:

Maple : $107M (-$16M)

Clearpool : $7M (-$4M)

Centrifuge : $79M (+$1M)

Ribbon : $11M (+$1M)

Goldfinch: $100M (+$1M)

Default:

Potential default of Orthogonal Trading on Maple pool. $10M payment has not been repaid today.

Auros, a major market maker missed a DeFi loan reimbursement on-chain. The entity stands for $15M or 5% of the overall on-chain outstanding loan amounts)