From OTC to EDX to DeFi - The circle of exchanges

Real world DeFi - The elephant in the Room #17

Two weeks ago, the launch of the crypto exchange EDX Market created a lot of noise (and signal ?) in the crypto ecosystem.

There are two main reasons for this.

The first (and the primary one) is that the exchange is backed by prominent names in asset management and TradFi (Citadel Securities, Schwab, Fidelity) as well as big institutions in crypto (Paradigm, Sequoia Capital).

From time to time, we witness big institutions acknowledging the importance of the digital asset ecosystem. It is great, but it is no big news: closer to communication strategy than real action.

This time is a bit different. The tense context between prominent crypto exchanges and SEC, lack of regulatory clarity in the US does not deter those institutions to do this announcement.

The second, and the most interesting for this article, is that the exchange will not directly hold participants' funds thus will be organised in a self-custodial fashion.

source: https://twitter.com/ramahluwalia/status/1671218916058705928

Market organisation and custody type

In these articles, I try to popularize the financial sector related to DeFi and provide some points for consideration.

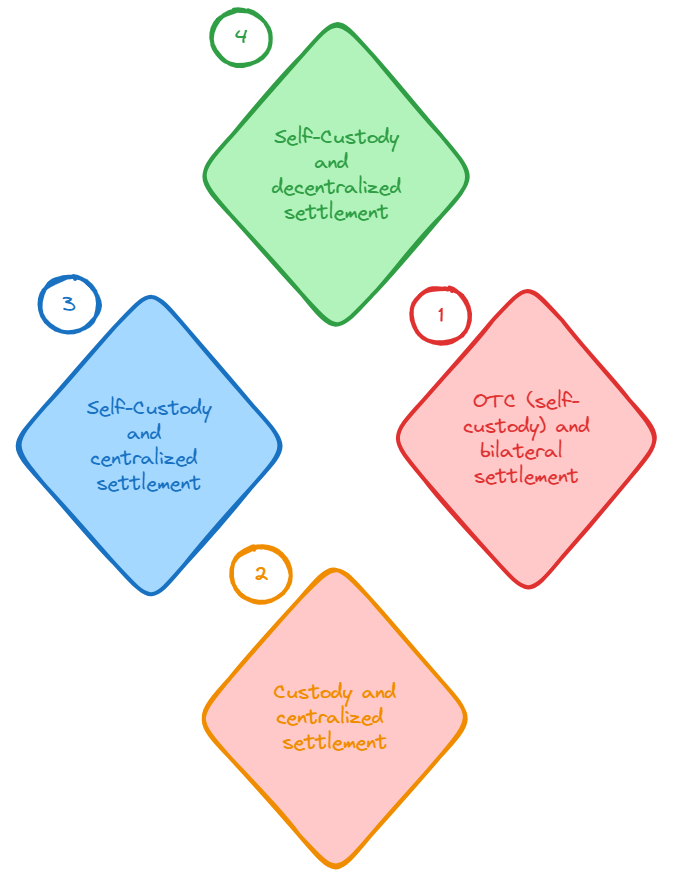

In my opinion, we can schematize financial market infrastructures since their creation in four phases.

This simplification is crude, impure, but effective when it comes to discussing EDX and the shape financial exchanges has been taking for eight centuries.

Why a circle? Because step 1 is close to step 4 both in terms of custody (self-custodial) and settlement (decentralized vs. bilateral).

The circle of exchanges is decomposed in four phases.

For multiple centuries until today: Self-custody & peer-to-peer settlement: OTC with bilateral clearing.

For centuries until today: Custody & centralized settlement

For 15 years: Self custody & centralized settlement: the case of EDX.

For 5 years: Self custody & decentralized settlement: DeFi prime brokerage era

Self-custody & peer-to-peer settlement: OTC with bilateral clearing.

Originally, most trades took place as over-the-counter (OTC) deals with bilateral settlement (no clearinghouse) and significant counterparty risk (no trusted third party in the exchange).

Before the creation of stock exchanges, financial securities (such as debt securities for example) were exclusively traded « over the counter », i.e. between a seller and a buyer who would meet in such places as the current Pont au Change in Paris or on the square in front of the inn held by the Van der Buerse family in Bruge.

Participants had complete control over their funds (self-custodial mode) without any higher authority overseeing the settlement.

Until today, OTC is still used by investment banks and their clients because:

It is a perfect way to create perfect hedging and cater exactly to your client needs

Quite convenient and fast to orchestrate and settle as you have a partner in trust.

However, OTC and bilateral clearing suffers from several pitfalls:

Asset prices are totally opaque

Illiquidity: no best bid/best offer.

Counterparty risk: as mentioned earlier, one had to trust their counterparty for trade settlement. It is great if it’s a long time partner, not so great in a market with many actors that you do not know.

These are markets that still thrive today, particularly for some asset classes like fixed income.

Custody & centralized settlement

Financial exchanges take their roots in Europe, starting in the 14th century in Belgium or later during the Renaissance in Holland, France or Germany.

Since the beginning of the 20th century, most markets (with listed stocks, bonds or commodities) have been organized based on models that favour price transparency. Also, the emergence of intermediaries is aimed at reducing counterparty risk.

The organization of those exchanges has two main consequences:

Participants are required to trade their assets on a margin account operated by an external entity to facilitate the liquidity of exchanges in the market. Thanks to those external entities markets can be organised in very efficient way:

Central Limit Order Books (CLOBs) have notably emerged to centralize all buy and sell orders for a given asset -operated by the participants and executed by the intermediairies- giving consistency on price discovery and facilitating transaction flows.Clearing houses who stands between the market participants are crucial. Their purpose is to reduce the risk of a participant failing to honor its trade settlement obligations.

Through an organisation in the form of multilateral markets instead of bilateral relationships:

prices are shared with everyone and become more transparent,

assets become more liquid (thanks to greater visibility of demand and supply facilitated by Central Limit Order Books), and

the counterparty risk is mitigated (reduced) through the exchange itself, along with a settlement institution.

However,

moving from a dependency on a single counterparty (in OTC) to a dependency on larger intermediaries (known to be too big to fail but still susceptible to failure)

The traded assets are standardized to facilitate market liquidity. It is harder to buy an asset that fully caters your need (i.e. for hedging purpose)

Furthermore, the exchanges are siloed from one another. It is not possible to post collateral on one exchange using capital from another exchange. The segmentation of exchanges results in the fragmentation of participants' capital across multiple platforms.

Crypto centralized exchanges (Coinbase & all) are organised in a similar fashion but suffer from a major flaw:

Systematically, trade settlement and custody is ensured by the same (or very-close) counterparty, leading to major outbreaks.

Self-custody & centralized settlement

The announcement of the EDX Market exchange made waves not only due to the prominent names of associated institutions but also because it will be structured without participants having to relinquish custody of their assets.

Unlike major global stock exchanges or crypto exchanges like Binance, Kraken, or Coinbase, users are not required to deposit their funds and transfer them to a counterparty.

Basically, benefits and flaws are comparable to centralized and custodial exchanges apart from removing one important intermediary (that is one person less to trust) and slighty improving the potential of interoperability.

Indeed, there is no need to block your capital on a specific platform, making you more flexible for cross-platforms strategies. However, since the trades take place off-chain, the exchange still require a centralized clearinghouse to settle them. It makes true inter-operation more difficult as time to settlement brings friction.

In that aspect EDX will launch EDX Clearing to settle trades matched on EDX Markets.

DeFi: self-custody & decentralized settlement

There is one final step to complete the loop:

Funds held in self-custody (as in OTC exchanges), and a generalized and decentralized settlement method instead of being solely peer-to-peer.

This is what DeFi proposes. Funds are held in a wallet where each individual is the sole holder of their private key. Exchange mechanisms take place through smart contracts, and their outcomes are immutably recorded on the blockchain (no centralized settlement)

The first on-chain decentralized markets emerged a few years ago, such as Uniswap V2 in 2020, powered by automated market makers and the famous formula X*Y=K. Today, increasingly sophisticated and modular infrastructures are being established (Uniswap V4, Balancer V2, Mangrove).

It is now possible to replicate Central Limit Order Books, structure interest rate or derivative markets on modular forms that could cater the need for very specific financial products (perfect hedging).

Also, it is even possible to establish decentralized prime brokerage services, enabled by the limitless composability of DeFi.

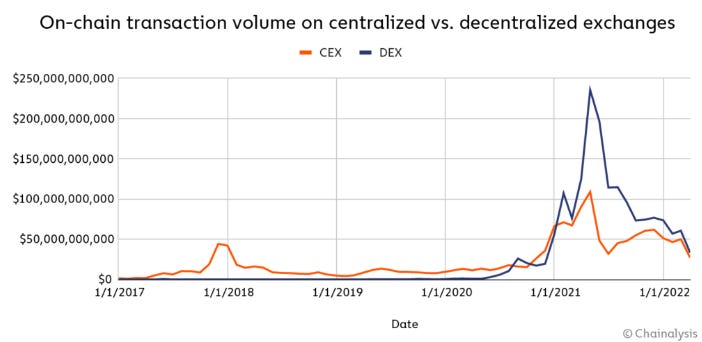

The speed of execution is impressive, with approximately four years between the release of Uniswap V1 and the appearance of the fourth version. As trading volumes on decentralized exchanges (DEXs) overtook those of centralized exchanges (CEXs) in terms of onchain volume*, it is foreseeable that this wave will rapidly impact the traditional financial (tradFi) world, provided three conditions are met:

Offering a stable compliance framework for participants (not entirely permissionless to prevent money laundering).

Avoiding the regulatory mood swings that may arise.

Improve onchain risk practices (audit, monitoring) and reduce hack risk.

* It should be noted that most of CEX volumes comes from off-chain venue due to centralized settlement.

Final words

Investment banks and funds have quickly adapted to new market infrastructures throughout the 20th century. Some are at the forefront of EDX innovation. It can be imagined that most of them will have an LP desk in the coming years as the regulatory ambiguity surrounding DeFi becomes clearer.

(Lp means liquidity provider in DeFi)

Love these articles