#8 - Two hundreds twenty millions and composability mess

Real World DeFi - The Elephant in the Room

$220 Million of Real-World Assets funding

Crypto winter did not start very long ago, but the it's getting cold.

While centralized crypto players have to deal with the fear and the fud (a few billion dollars out from Binance), interesting signals are emerging in decentralized finance.

Last Wednesday, Maker and BlockTower announced the funding of a fund for non-crypto players on Centrifuge protocol.

The size of the fund is $220 million with Bloctower providing $70 million as first-loss capital and Maker $150 million in senior funding.

How it works?

Blocktower Credit (credit arm of the SEC-registered BlockTower Capital) is an asset manager that gives access to a diversified and qualitative set of asset classes. Its role is to originate, gather and structured those underlying actors financing needs (loans) into securitised assets.

Those underlying loans include commoditized credit assets (i.e. mortgages, unsecured consumer, auto loans, etc) and shorter duration assets across consumer finance, tax receivables factoring, trade finance

Centrifuge is the technological bridge for this transaction. It implements a way to bridge the real financial assets of Blocktower into tokens and distributes them to Maker

Maker is the investing party in this transaction. The purpose of this investment is twofold.

To make it more capital efficient and to promote its expansion: the DAI mint is not done in exchange for an over-collateralized token in this case but rather for a transfer of DROPs (which are the tokens representing the shares in the pools)

Increase protocol revenues as off-chain interest rates are not governed by on-chain market laws (where market supply is much greater than demand and rates are very low)

Blocktower credit also acts as an investor in the pools it originated by providing the first-loss capital (TIN token) in case of underlying borrowers defaults. This first loss capital materializes alignement of interest between the Maker (the lender) and Blocktower (the structurer).

Why is it big?

Pretty simple.

Current total amount borrowed in Centrifuge is $77M

Total amount raised since Centrifuge inception is $205M

Centrifuge would potentially more than doubles the overall outstanding amount financed in the protocol if the funding capacity would be fully funded. It would also becomes a leader in the RWA credit market world in terms of outstanding loans.

Next steps

Steady lads, deploying more institutional liquidity

In my opinion, the best thing to look forward to during this bear market is the proliferation of traditional players attempting to borrow or lend on-chain over public DeFi protocols.

Signals like Forge's borrowing from Maker are likely to multiply:

On-chain heuristics - A follow-up on composability

I recently announced that I was building Valha, an abstraction layer on top of decentralized finance.

Valha responds to the lack of composability in DeFi and to the effort of developers to integrate a protocol to a platform or to another protocol.

To illustrate the lack of standardization that DeFi is facing today and to follow-up of my last time newsletter edition about boring little standards, here is a rough analysis on the diversity of way to call a deposit action on-chain:

The scope

I collected information on 85 protocols from 9 Layer 1 or Layer 2 (Ethereum, Arbitrum, Optimism, Avalanche, Polygon, BSC, Celo, Fantom, Tron), accounting for more than 80% of current TVL in decentralized finance.

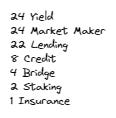

The distribution of the number of protocols is as follows:

The method

I gathered information at the smart contract level on how five functions were called:

deposit, withdraw, stake, unstake and claim.

The deposit function consists of depositing a token (often a stablecoin, the chain's native token, or a known ERC-20) into a vault in order to generate yield and subsequently receive an LP token.

Withdraw is the opposite action.

The stake function consists of placing the LP token gleaned by the deposit action in a new location to earn additional return (ancillary fees, liquidity mining).

Unstake is the opposite action.

The claim function consists in recovering the rewards earned by the investor if they are not directly accumulated in the token value.

It should be noted that there are sometimes functions in the smart contract which allow to cumulate several actions (deposit and stake, claim and unstake) which are not taken into account here.

We focus here on the deposit function.

I will post a more detailed analysis in a few days with other highlights and new functions (withdraw, stake, unstake, claim)

The big highlights

Deposit

36 different deposit function names

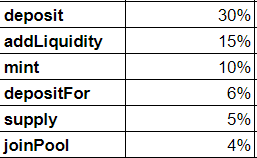

Top 6 function name and their frequency of occurrence (out of 104 cases)

26 argument types

Top 7 argument types and their frequency of occurrence (at least once in the function arguments)

33 argument types combination out of 104 occurences (not taking into account order). On average, there is three occurrences of function with the same number and types of arguments for the deposit action.

The distribution is not uniform, in majority we have a single uint256 (basically a number) as a argument, or an address and an uint256.Mean number of arguments per pool types:

AMMs are the pools that require the most arguments to deposit as a liquidity provider at the opposit of native ETH staking functions which requires less than 1 argument on average.

New hope

Several complementary avenues can be explored to improve composability in DeFi:

ERC-4626: A token standard for yield-bearing vaults

Valha, open-source ad-hoc connectors

Super composable Yield: An ERC 4626-like standard that also apply to AMM pools.

A glance at on-chain credit protocol figures

It has been 5 weeks since the FTX insolvency was discovered and it continues to affect the DeFi credit protocols.

The clearpool and ribbon pools have almost been emptied, whereas they were accumulating at 100M outstanding loans 6 weeks ago.

Maple, which recently released its V2, has been hit hard by Orthogonal Trading's insolvency and has seen its loan amounts melt away (as well as the amount of its defaults skyrocket with $36M of

Orthogonal Trading unpaid loans!!).

Only Goldfinch and Clearpool make it through without a scratch: no loss, no outstanding loans reduction. This is because they do not target the same borrowers: no crypto asset managers, hedge funds but off-chain entities dealing with consumer and SME loans, embedded finance, trade finance or Real Estate.

Outstanding Loans:

Maple : $43M (-$64M)

TrueFi: $14M (+$0M)

Clearpool : $0.35M (-$7M)

Centrifuge : $77M (-$2M)

Ribbon : $0M (-$11M)

Goldfinch: $101M (+$1M)

Winter is hard, are we seeing the end of it soon?